WELCOME TO THE MILIKOWSKY TAX LAW BLOG

Providing actionable insights and valuable information to help you navigate the complexity of tax law for your business.

SBA PPP and Fintech, the Next Wave of Funding

Fintech Gets In the Game

The Paycheck Protection Program (PPP) funds were exhausted within the first 2 weeks of the program. TOmorrow, April 23rd, 2020, Congress will release another $310Billion for teh SBA to offer to small businesses as…

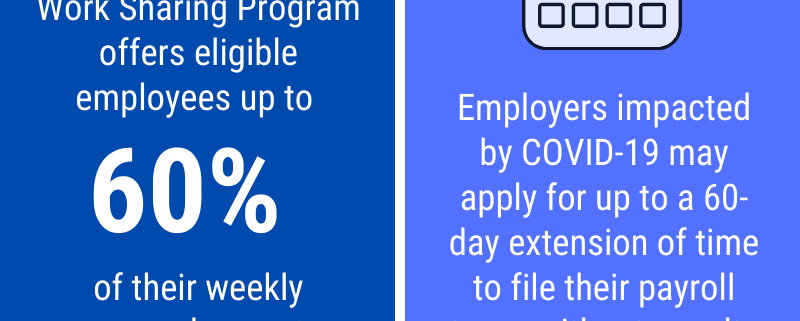

Delayed Tax Filings & Payments

In the case of delayed tax filings and payments, who is offering them, and should I wait to file and pay?

The coronavirus pandemic has taken a toll on the economy, and the effects have been undoubtedly felt across the world.

Due to the widespread…

What Is an EDD Benefit Audit?

If you’re a business based in California, you’ve likely had dealings with the Employment Development Department (EDD).

It is the responsibility of the EDD to collect payroll taxes and it conducts payroll tax audits of companies and…

SBA PPP Runs Out of Funding

$350Billion Dollars in Funding Depleted

The Paycheck Protection Program—part of the multi-trillion dollar CARES Federal Stimulus package meant to offset the massive economic slowdown associated with the COVID-19 pandemic—is running into…

Irs Sends Money Instead of Receiving Money This April 15th

April 15th Takes on New Meaning in 2020

For most Americans, April 15th is no day for celebration. We pay our taxes, dutifully (if somewhat begrudgingly from time to time) and get on with the business of, well, business.

Today, many of…

What Is the Difference between Criminal Tax Evasion and Civil Tax Penalties?

In the eyes of the federal government, there is a vast difference between a criminal tax fraud offense and a civil fraud offense. These differences focus primarily on the different burdens of proofs, penalties, statues of limitations, and…

Is IRS Still Auditing? [video]

If you are currently being audited by IRS or EDD, be certain that you get a delay or postponement in writing.

IRS and EDD are still auditing. The outbreak is not stopping work at CA EDD or IRS. Despite the chaos caused by the recent…

Can I Hire 1099s to Stay in Business During COVID-19?

As many companies work to reorganize their business model in light of COVID-19, hiring a 1099 to replace your full-time employees might be a great solution. However, there are a few things to consider before taking the step in hiring these…

COVID-19 Business Owner Resources

As business owners, and former business owners, we at Milikowsky Tax Law know how challenging these times can be. Here are resources specifically focused on the Small to Mid-Sized Business Owner (under 500 employees). If you find yourself…

IRS Is Limiting Certain Enforcement Actions

In a surprising turn of events, IRS is limiting certain enforcement actions. To read the entire article visit IRS.gov

"The new IRS People First Initiative provides immediate relief to help people facing uncertainty over taxes," Rettig added…

International Tax Audits

The area of international taxation is incredibly complex. It requires a detailed understanding of the laws of the countries involved in the transactions, as well as how various treaties impact the tax consequences of business operations. At…

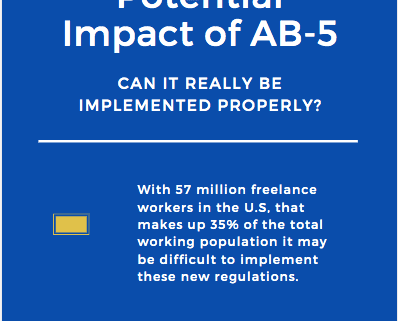

Will AB-5 Withstand Coronavirus?

As we look forward from April into the second quarter of 2020 the question on many business owner's minds is: will the rules outlined in AB-5 stand in the face of coronavirus? At the start of 2020, business owners' level of concern about California…